WILLIS TOWERS WATSON (WTW)·Q4 2025 Earnings Summary

WTW Beats on Both Lines as Organic Growth Accelerates to 6%

February 3, 2026 · by Fintool AI Agent

Willis Towers Watson (NASDAQ: WTW) delivered a solid Q4 2025, beating both revenue and EPS estimates as organic growth accelerated to 6% and adjusted operating margins expanded 80 basis points year-over-year. The stock was essentially flat following the report, closing down 0.3% as results largely matched elevated expectations.

CEO Carl Hess highlighted "strong performance across our businesses driven by our team's relentless focus and consistent execution of our strategy."

Did WTW Beat Earnings?

Yes — WTW beat on both revenue and EPS.

Reported revenue declined 3% year-over-year due to the sale of TRANZACT, but organic revenue growth of 6% was the highlight — a notable acceleration from 5% for the full year.

GAAP diluted EPS of $7.62 was down 38% YoY, but this comparison is distorted by a prior-year gain on disposal of operations. On an adjusted basis, EPS grew 2%.

How Did the Segments Perform?

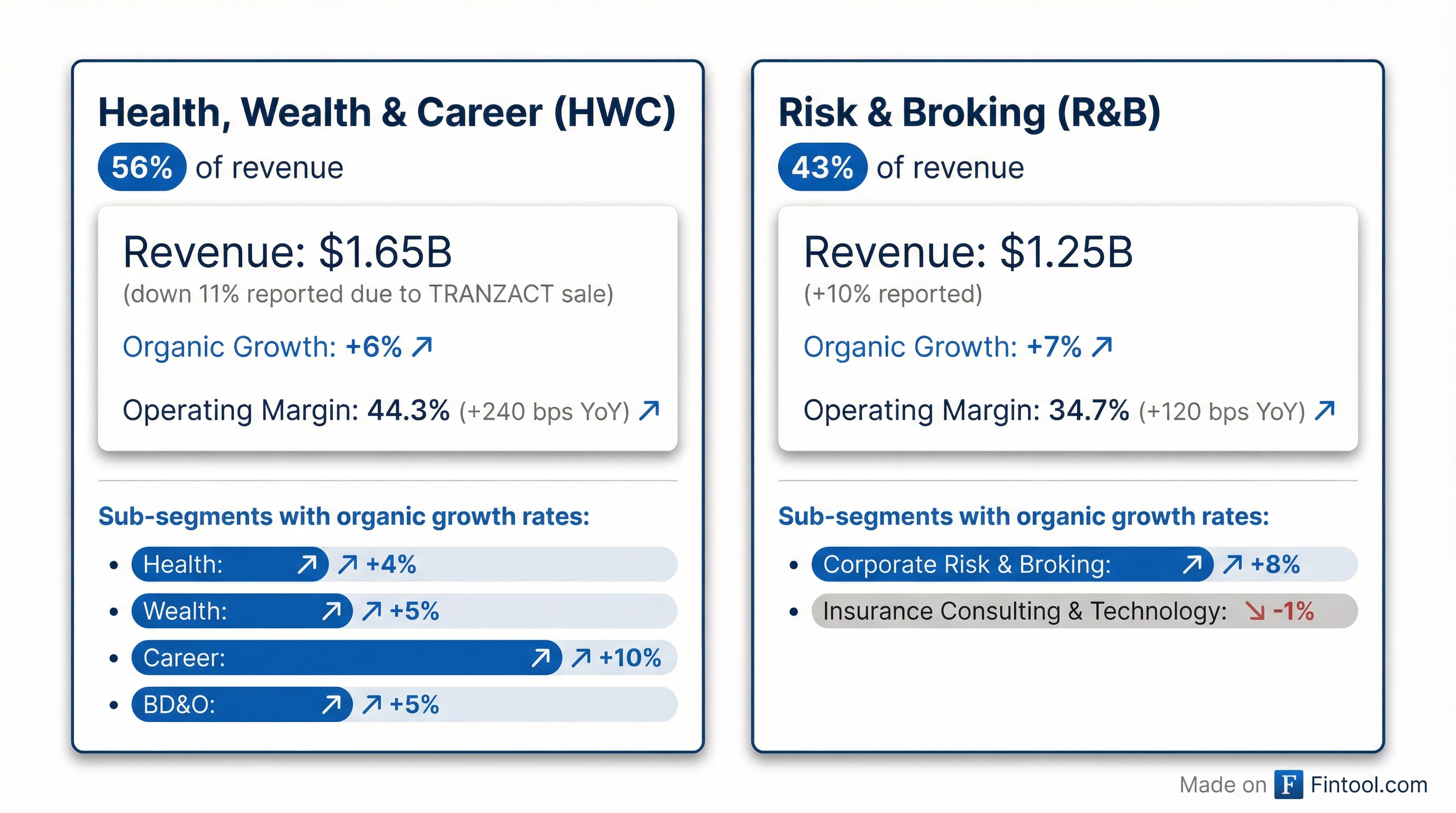

WTW reports in two segments: Health, Wealth & Career (HWC) and Risk & Broking (R&B). Both delivered solid organic growth with margin expansion.

Health, Wealth & Career (HWC)

The reported revenue decline reflects the TRANZACT sale. Excluding that impact, organic growth was strong across all sub-segments:

- Career led with +10% organic growth, driven by robust demand for advisory services and compensation benchmarking

- Wealth grew +5% from strong Retirement work across all regions plus Investments growth

- BD&O grew +5% from higher commission revenue and administration work

- Health grew +4%, led by double-digit increases in International

Risk & Broking (R&B)

R&B continues to be the growth engine:

- Corporate Risk & Broking (CRB) grew +8% organically from higher new business activity and strong client retention globally

- Insurance Consulting & Technology (ICT) declined -1%, reflecting clients' expense management amid economic uncertainty

What Did Management Guide?

Management provided a constructive outlook for 2026, emphasizing continued margin expansion:

Adjusted Operating Margin:

- R&B: ~100 bps average annual margin expansion over the next 2 years

- HWC: Incremental annual margin expansion continuing

Capital Allocation:

- Share repurchases of $1.0B or greater in 2026, subject to market conditions

2026 Headwinds/Tailwinds:

The Newfront acquisition is expected to generate ~$250M in post-close revenue in 2026 with an adjusted EBITDA margin of ~26%.

How Did the Stock React?

Muted reaction — the stock closed essentially flat after the earnings release.

The lack of significant movement suggests the market had largely priced in strong results. WTW has been a steady performer, delivering 8 consecutive quarters of organic growth.

What Changed From Last Quarter?

Key changes:

- Organic growth accelerated from 5% in Q3 to 6% in Q4, driven by Career's 10% growth

- Career benefited from a book-of-business sale that boosted the quarter

- Free cash flow margin improved to 15.9% for full year, up 310 bps from 12.8% in FY24

- Transformation program completed — restructuring costs were zero vs $32M in Q4 2024

Full Year 2025 Summary

Management delivered on all 2025 financial objectives and returned $2.0B to shareholders through buybacks ($1.65B) and dividends ($358M).

Capital Allocation & Balance Sheet

WTW has been aggressive on buybacks, repurchasing $1.65B of stock in 2025 — nearly double the prior year. The leverage ratio ticked up to 2.4x from 2.0x, partly due to M&A activity, but remains within their 2.0x-2.5x target range.

Key Risks & Concerns

-

TRANZACT Overhang — The Medicare brokerage divestiture creates tough comps and may mask underlying growth trends in HWC

-

ICT Weakness — Insurance Consulting & Technology declined 1% as clients remain cautious on expenses

-

Willis Re JV Impact — The joint venture creates a $0.30 EPS headwind in 2026, and remaining equity investments are not expected to be material

-

Leverage Increase — Debt/EBITDA rose to 2.4x, limiting M&A flexibility while at the high end of target range

Bottom Line

WTW delivered a clean beat with 6% organic growth and 80 bps of margin expansion. The multi-year transformation is complete, cost savings are flowing through, and management is executing on capital returns. The 2026 outlook is constructive with continued margin expansion guided, though the Willis Re JV creates a near-term EPS headwind.

The muted stock reaction suggests this was a "meet expectations" quarter — solid execution, no negative surprises, but nothing dramatic enough to move the needle. WTW remains a steady compounder in the insurance brokerage space.

Related Resources: